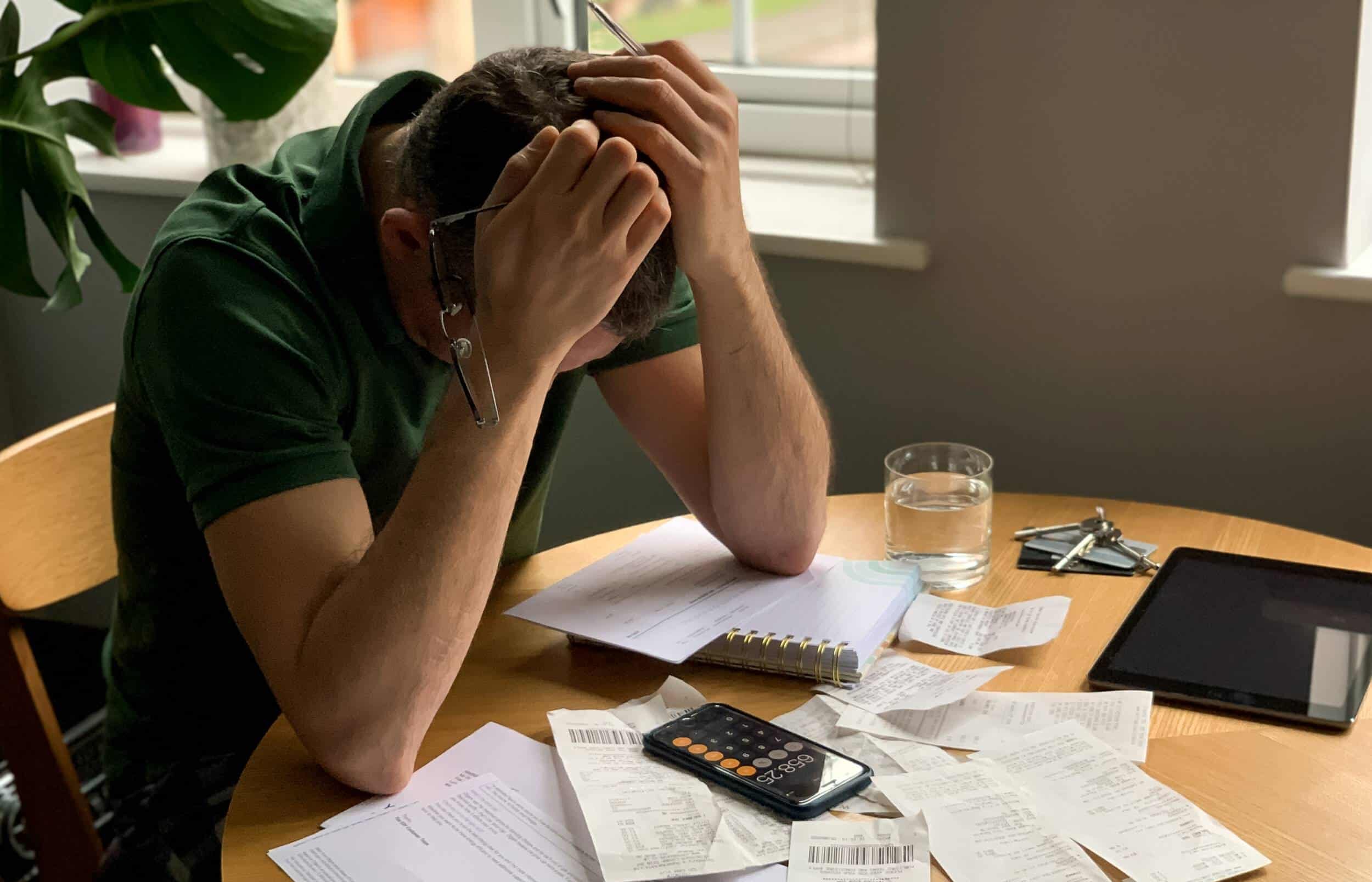

Financial stress can play a significant part in our lives. Not having the means to participate in our lives the way in which we want to or how others expect us to is stressful. Not having the money to attend a dinner, attend an event, or make life altering purchases such as a home or a car can make us feel shame, embarrassment, and even inadequate.

How has discussion of money and finances been taught to you through your early development?

How has culture influenced the way in which money is or is not talked about?

How do gender norms within your family of origin impact your competency of financial stability and/or success?

How does a parent’s ability to provide financially for their family inform a sense of safety and security?

How does the absence of financial participation from an estranged parent shape the relationship between parent and child?

Some of us have been fortunate to have grown up in financially secure families where money for groceries, new clothes for school, field trips, band equipment were not a second thought. This isn’t everyone’s experience. Many families do experience financial stress and rely on both parents and older children to contribute to the family’s financial needs.

Money is undoubtedly influential. It not only impacts education, where we live, our community, sports, our health care, transportation and access to jobs – it also informs our worldview and our place in it. Our financial upbringing can cause us to feel entitled, defeated, self-conscious, anxious, worried, motivated, and more.

The holidays can increase financial stressors. You may feel like you want to express your feelings toward others through gift giving but do not actually have the means to do so. Your income just doesn’t match the generosity that you feel. This can be particularly difficult for parents who do not have the ability to give in the way that they would like to their children.

Whether financial stressors are new or have been life long, they can significantly impact our mental health. Our moods, temperaments, motivation, and relationships can be affected by the way in which finances shape our lives. Therapists and psychologists can facilitate conversations about financial stressors and introduce coping skills. Maybe going to therapy doesn’t seem financially possible. Some therapists offer sliding scale rates to accommodate varying needs. It is also possible that your health insurance has coverage for mental health care.

Stay Updated With The Most Recent News & Blogs From Soultenders.

Get blog articles and offers via email